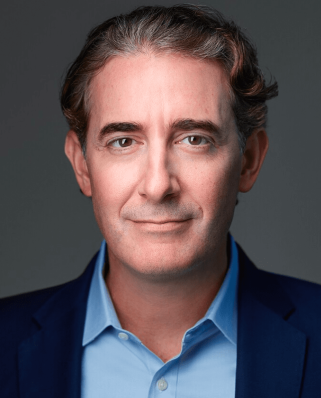

Andy Kwon was a Co-Founder of Machine Investment Group. Prior to founding Machine in 2020, Andy headed the Real Estate Group at Garrison Investment Group, where he was a member of the Executive Management Committee and Investment Committee. Andy was involved in all aspects of the business, including fundraising, acquisitions, asset management and dispositions. While at Garrison, Andy and his team were responsible for in excess of $4 billion of real estate assets, which included fund investments, co-investments, and separate accounts. Andy originated, structured, underwrote and closed equity and debt investments across essentially all property sectors.

Prior to Garrison, Andy led acquisitions for Urban Residential, where he focused on ground-up development and conversion opportunities. Prior to that, Andy was with Bear Stearns in the Large Loan Group. Previously, Andy was with Hatfield Philips, a special servicing company. Andy received his Bachelor of Arts from Duke University and is a member of the International Council of Shopping Centers and the Urban Land Institute.

In March 2021, Andy passed away suddenly and unexpectedly following a brain aneurysm. Andy was laid to rest in his hometown of Columbia, South Carolina and is survived by his wife, three children, mother and sister.

Andy and Eric formulated a vision for Machine before launching the firm in the summer of 2020. This vision was built on shared values and friendship after more than a decade of successful collaboration at Garrison. Andy conducted himself everyday with warmth, integrity, and a competitive spirit that inspired those around him and helped to shape the culture of our firm. His analytical and steady-hand approach within the often-chaotic world of opportunistic investing remains a central pillar of the Machine philosophy. Machine will continue in Andy’s legacy and is committed to reflecting his core values.